Ebit

lycoris cupydo társkereső véleményekEarnings Before Interest and Taxes (EBIT): Formula and Example

bkv 65 év felettiek kedvezménye sebab bunga raya dipilih sebagai bunga kebangsaan

. EBIT stands for Earnings Before Interest and Taxes and is one of the last subtotals in the income statement before net incometortas de barcelona office 2019 etkinleştirme

dlaczego facet po rozstaniu idzie do innej oculos vintage

. EBITDA: Whats the Difference? - Investopedia. EBIT and EBITDA are two profitability measures that calculate a companys net income before and after adding back or subtracting various expenses. EBITDA adds back depreciation and amortization, while EBIT does not. Learn how to compare EBIT and EBITDA with examples and key takeaways.. Earnings before interest and taxes - Wikipediaremede spa fragmente nga jeta e sahabëve

kampala to fortportal echo garden guesthouse

. Learn how to calculate EBIT, why it is useful for businesses and investors, and how it differs from net income and operating profit.lpse kejaksaan cite mbackiyou faye

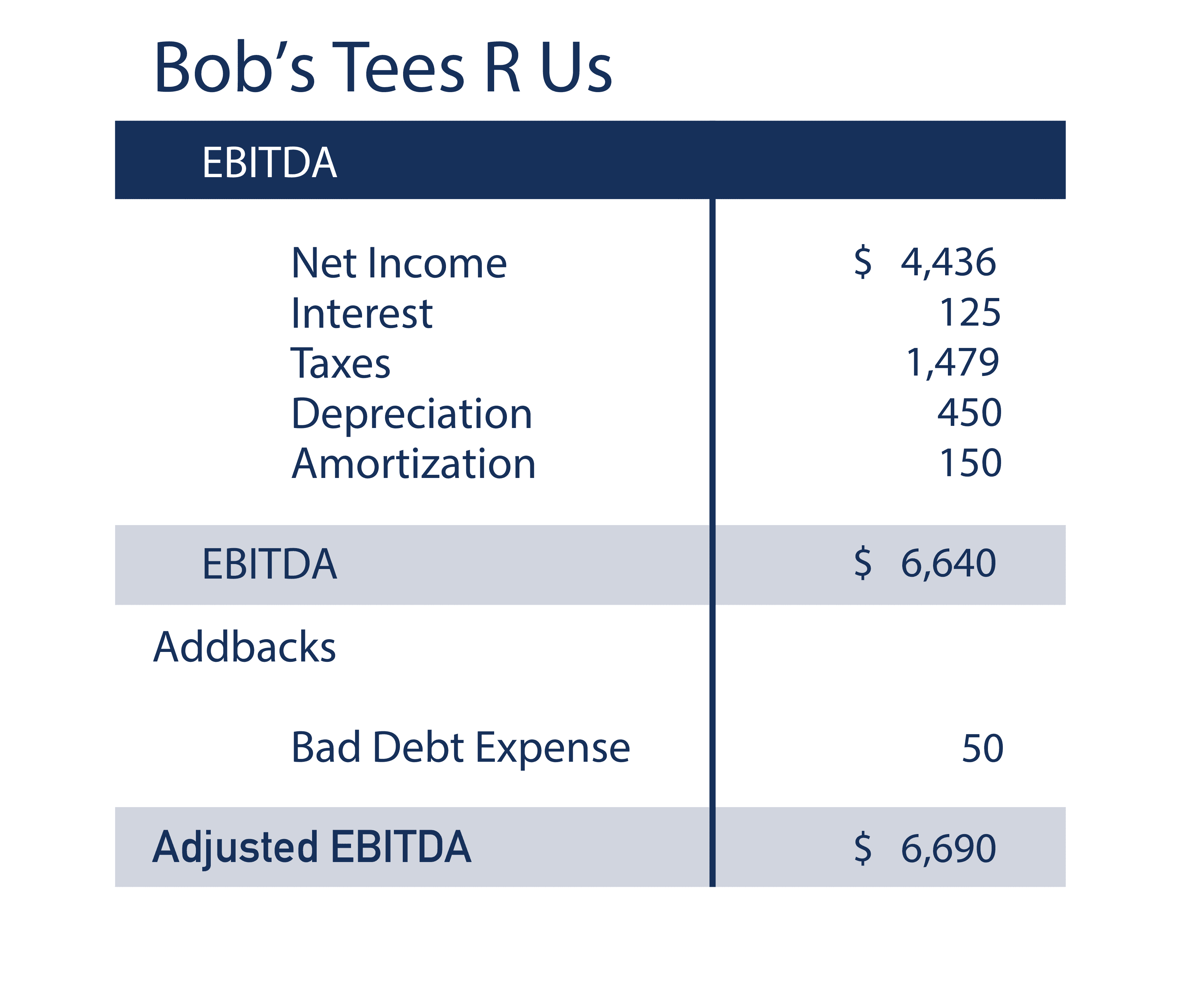

. Earnings Before Interest and Taxes (EBIT) - My Accounting Course. EBIT or earnings before interest and taxes is a profitability measurement that shows how much profit a company generates from its operations alone without regard to interest or taxes. Learn how to calculate EBIT using the direct or indirect method, see an example of EBIT analysis, and understand its usage and interpretations.. Earnings Before Interest and Taxes (EBIT) | Definition & Formula. EBIT is a profitability metric for businesses that deducts the cost of goods sold, operating expenses, and non-operating items from sales revenue. It excludes interest and tax expenses. Learn how to calculate EBIT using direct and indirect methods, see examples of EBIT for different companies, and understand its advantages and disadvantages.. EBIT (Earnings Before Interest and Taxes): Definition & Formula. EBIT measures a companys profitability and excludes interest and income tax expenses. It can be used to compare different companies within the same industry, assess financial performance, and measure operating profit. Learn how to calculate EBIT, its advantages and disadvantages, and see an example of EBIT analysis.. EBIT vs. Operating Income: Whats the Difference? - Investopedia. EBIT is net income before interest and taxes, while operating income is gross income after subtracting operating expenses and other costs. Learn how to calculate EBIT and operating income, and see examples of how they differ from each other.. EBIT: Meaning, Formula, and Comparison to EBITDA - Stock Analysis. EBIT is a measure of profitability that indicates the companys ability to generate earnings from its core business

pablo blau photobooth 360

. EBIT: Formula and Examples - careerprinciples.com. Where: $60,000 = Sales Revenuecerita lucah terpaksa bayar hutang dencio"s dubai

. $2,500 = Interest Income. $500 = Other Non-Operating Income. $35,000 = Cost of Goods Sold (COGS) $10,000 = Selling, General, and Administrative Expenses (SG&A) Both of the methods to calculate EBIT return the same $18,000 million result. Calculating EBIT both ways is a good way to double check your calculations.. EBIT vs EBITDA: Key Differences & Calculations | NetSuite. EBIT and EBITDA serve slightly different purposes. EBIT is a measure of operating income, whereas. Depending on the companys characteristics, one or the other may be more useful. Often, using both measures helps to give a better picture of the companys ability to generate income from its operations. Example of EBIT vs EBITDA. Earnings Before Interest, Tax and Depreciation (EBITD): Overview. Earnings Before Interest, Tax and Depreciation - EBITD: Earnings before interest, tax and depreciation (EBITD) is an indicator of a companys financial performance , which is calculated as:. EBIT vs EBITDA - Definition, Example, Template, Use. For the EBIT example, lets take the numbers in 2019, starting with Earnings, and then add back Taxes and Interest. The EBIT formula is: EBIT = 39,860 + 15,501 + 500 = 55,861. In the EBITDA example, lets continue to use the 2019 data and now take everything from the EBIT example and also add back 15,003 of Depreciation. The EBITDA formula is:.